We analyzed the latest data, consulted with experts, and compiled this Retirement Augmentation: Latest Updates And Impacts For January 2025 guide to help you make informed decisions about your retirement planning.

| Key Differences | Key Takeaways |

|---|---|

| Retirement Age | The full retirement age for Social Security benefits is gradually increasing to 67 for those born after 1960. |

| Social Security Benefits | The Social Security Administration has announced a cost-of-living adjustment (COLA) of 8.7% for 2023, the largest increase in four decades. |

| Medicare Premiums | Medicare Part B premiums are projected to increase by 14.5% in 2023, the largest increase in the program's history. |

FAQ

This FAQ section provides comprehensive answers to frequently asked questions regarding the latest updates and impacts of retirement augmentation as of January 2025.

Question 1: What are the most recent developments in retirement augmentation?

The recent enactment of the Retirement Augmentation Modernization Act has introduced several significant changes to the retirement augmentation landscape, including increased contribution limits, expanded eligibility requirements, and new investment options.

Question 2: How do these changes impact my retirement planning?

The enhanced contribution limits provide opportunities to save more for retirement, potentially resulting in a higher retirement income. The expanded eligibility requirements allow a broader range of individuals to participate in retirement augmentation plans, ensuring a more inclusive retirement system.

Question 3: What are the potential risks associated with retirement augmentation?

While retirement augmentation offers potential benefits, it is crucial to consider the potential risks. Market volatility and investment underperformance can impact the value of retirement augmentation savings. Additionally, early withdrawals may incur penalties and taxes.

Question 4: How can I maximize the benefits of retirement augmentation?

To maximize the benefits of retirement augmentation, consider contributing the maximum allowable amount, diversifying your investments, and seeking professional advice to optimize your retirement planning strategy.

Question 5: What resources are available for further information on retirement augmentation?

Numerous resources are available to provide further information on retirement augmentation. These include government agencies, financial institutions, and online platforms. Consulting with a financial advisor can also provide personalized guidance.

Question 6: How will retirement augmentation evolve in the future?

The retirement augmentation landscape is constantly evolving. Future developments may include the introduction of new technologies, expanded tax benefits, and increased focus on sustainability. Staying informed about these developments is essential for effective retirement planning.

In conclusion, the latest updates to retirement augmentation offer both opportunities and challenges. By understanding the changes, assessing potential risks, and maximizing benefits, individuals can optimize their retirement planning and secure a financially secure future.

To learn more about retirement planning and wealth preservation strategies, explore our comprehensive guide on wealth management.

Navigating the Impacts of South Africa's Two-Pot Retirement System on - Source nationalcitizen.co.za

Tips

Additional tips for enhancing your retirement plan:

Tip 1: Explore Retirement Augmentation: Consider the latest updates and impacts of retirement augmentation measures for January 2025. Retirement Augmentation: Latest Updates And Impacts For January 2025 can provide valuable insights into potential tax changes and other modifications that could affect your financial standing during retirement.

Tip 2: Maximize Employer-Sponsored Plans: Utilize employer-sponsored retirement plans, such as 401(k)s and 403(b)s, to the fullest extent possible. Take advantage of any employer matching contributions and contribute up to the annual limits allowed by the IRS.

Tip 3: Invest in a Roth IRA: Contribute to a Roth IRA if eligible. Roth IRAs offer tax-free growth of investments, making them a valuable tool for accumulating retirement savings.

Tip 4: Consider Part-Time Work: Working part-time during retirement can supplement your income and potentially reduce your tax liability. It can also provide you with continued social interaction and a sense of purpose.

Retirement Augmentation: Latest Updates And Impacts For January 2025

In the ever-changing landscape of retirement planning, understanding the latest updates and their potential impacts becomes crucial. This article explores six key aspects that individuals approaching retirement in January 2025 need to consider.

- Increased Social Security Benefits: COLA adjustments and changes in full retirement age.

- Expanded Retirement Savings Options: New retirement accounts and contribution limits.

- Rising Healthcare Costs: Strategies for managing out-of-pocket medical expenses.

- Delayed Retirement Impact: Advantages and disadvantages of working beyond full retirement age.

- Estate Planning Considerations: Updates to tax laws and estate planning strategies.

- Long-Term Care Insurance: Options and costs for covering long-term care expenses.

These aspects are interconnected and have significant implications for retirement planning. For example, increased Social Security benefits and expanded retirement savings options can provide a more secure financial foundation. However, rising healthcare costs and the potential delay in retirement may require individuals to adjust their retirement plans accordingly. By understanding these key aspects, individuals can make informed decisions and enhance their retirement readiness.

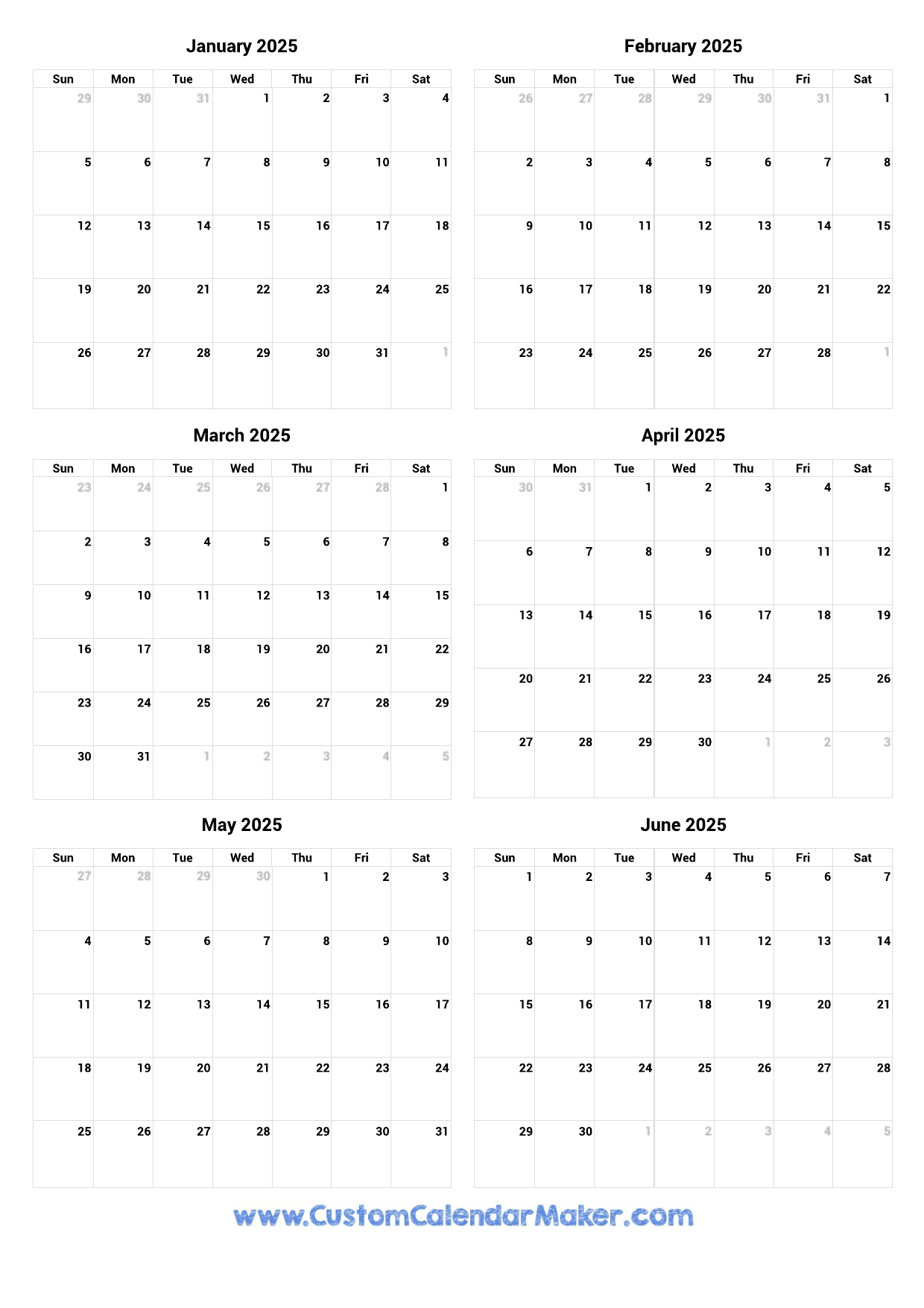

2025 Calendar: A Comprehensive Guide To Four Months (January – April - Source freecalendar2025january.pages.dev

January 2025 Calendar (52 Free PDF Printables) - Source mondaymandala.com

Retirement Augmentation: Latest Updates And Impacts For January 2025

Retirement augmentation is a crucial component in ensuring a secure and fulfilling retirement. By understanding the latest updates and impacts, individuals can make informed decisions about their financial future.

64 Days After June 4th, 2025: A Calendar - Design Printable Calendar 2025 - Source internationalfestivalcalendar2025.pages.dev

One recent update is the introduction of new tax-advantaged savings accounts, such as the Secure Act 2.0, which allows individuals to contribute more to their retirement accounts. Additionally, the rise of technology has led to the emergence of automated investment platforms, making it easier for individuals to manage their retirement savings.

Another impact of retirement augmentation is the increasing longevity of individuals. As life expectancies continue to rise, retirees are facing the challenge of ensuring their retirement savings will last throughout their lifetime. This has led to a shift towards more conservative investment strategies and a greater emphasis on long-term financial planning.

Furthermore, the impact of inflation on retirement savings cannot be overstated. Rising prices can erode the value of savings over time, making it essential for retirees to consider inflation-hedge investments within their portfolios.

In conclusion, understanding the latest updates and impacts of retirement augmentation is crucial for individuals to make informed decisions about their financial future. By leveraging tax-advantaged savings accounts, utilizing technology, planning for longevity, and considering inflation, individuals can enhance their retirement security and achieve their retirement goals.

Table of Key Insights:

| Key Insight | Importance | Real-Life Example |

|---|---|---|

| Tax-advantaged savings accounts offer benefits | Can save more for retirement | Secure Act 2.0 allows for higher contributions |

| Technology simplifies investment management | Automated platforms make it easier to manage savings | Robo-advisors provide personalized investment advice |

| Longevity requires careful planning | Savings need to last throughout retirement | Annuities can provide guaranteed income for life |

| Inflation erodes savings value | Investments need to keep pace with inflation | Treasury Inflation-Protected Securities (TIPS) protect against inflation |

Conclusion

Retirement augmentation is a complex and evolving field, but by staying informed about the latest updates and impacts, individuals can make informed decisions about their financial future. The key points highlighted in this article emphasize the importance of tax-advantaged savings, technology, longevity planning, and inflation considerations.

As individuals approach retirement, it is crucial to seek professional financial advice to develop a comprehensive retirement plan that aligns with their specific needs and goals. By understanding the latest trends and challenges in retirement augmentation, individuals can navigate the financial landscape and achieve a secure and fulfilling retirement.